Is There Property Tax In New York . The average effective property tax rate in. Property taxes in new york vary greatly between new york city and the rest of the state. Most taxpayers in new york state receive two tax bills each year: Calculating your annual property tax. Learn how property tax exemptions, tax rates, and credits work in new york state. Your property tax rate is based on your tax class. School tax bills are generally the first to arrive. There are multiple ways to compare property tax rates across states, as seen in the following table. If you own a home in new york, you'll need to pay property taxes. The tax rates are listed below. In new york city, property tax rates are actually quite low. To estimate your annual property tax: Multiply the taxable value of your property by the current. Explore property records (acris) apply for tax. There are four tax classes.

from www.osc.state.ny.us

The average effective property tax rate in. There are multiple ways to compare property tax rates across states, as seen in the following table. The tax rates are listed below. Learn how property tax exemptions, tax rates, and credits work in new york state. To estimate your annual property tax: There are four tax classes. School tax bills are generally the first to arrive. Explore property records (acris) apply for tax. What would you like to do? Learn how we calculate your annual.

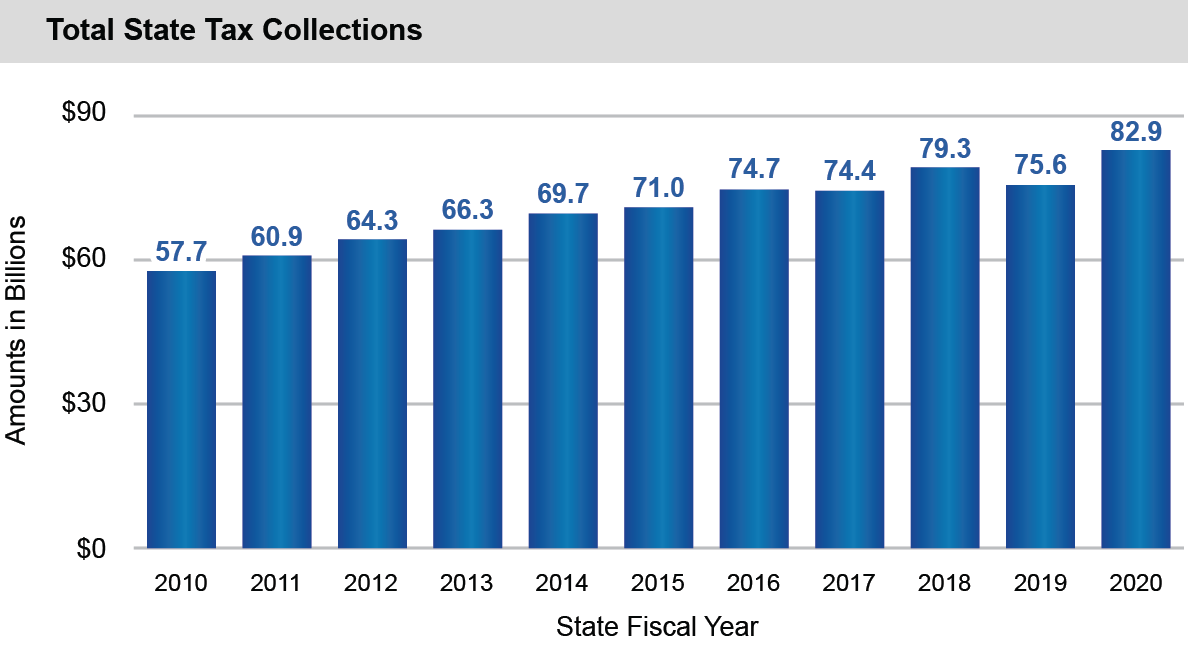

Taxes 2020 Financial Condition Report Office of the New York State

Is There Property Tax In New York Most taxpayers in new york state receive two tax bills each year: Explore property records (acris) apply for tax. To estimate your annual property tax: The tax rates are listed below. Calculating your annual property tax. Your property tax rate is based on your tax class. What would you like to do? School tax bills are generally the first to arrive. Multiply the taxable value of your property by the current. There are multiple ways to compare property tax rates across states, as seen in the following table. In new york city, property tax rates are actually quite low. Most taxpayers in new york state receive two tax bills each year: Learn how we calculate your annual. Learn how property tax exemptions, tax rates, and credits work in new york state. If you own a home in new york, you'll need to pay property taxes. Property taxes in new york vary greatly between new york city and the rest of the state.

From longislandbusiness.com

Report New York Is 2024’s State with the 6th Highest RealEstate Is There Property Tax In New York Learn how property tax exemptions, tax rates, and credits work in new york state. What would you like to do? Learn how we calculate your annual. Property taxes in new york vary greatly between new york city and the rest of the state. Your property tax rate is based on your tax class. There are four tax classes. The tax. Is There Property Tax In New York.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Is There Property Tax In New York There are four tax classes. Learn how we calculate your annual. Learn how property tax exemptions, tax rates, and credits work in new york state. In new york city, property tax rates are actually quite low. What would you like to do? The average effective property tax rate in. Explore property records (acris) apply for tax. To estimate your annual. Is There Property Tax In New York.

From www.citylab.com

Why Billionaires Don't Pay Property Taxes in New York CityLab Is There Property Tax In New York There are four tax classes. The tax rates are listed below. To estimate your annual property tax: If you own a home in new york, you'll need to pay property taxes. In new york city, property tax rates are actually quite low. Learn how property tax exemptions, tax rates, and credits work in new york state. Multiply the taxable value. Is There Property Tax In New York.

From cbcny.org

New York City Property Taxes CBCNY Is There Property Tax In New York Multiply the taxable value of your property by the current. Learn how we calculate your annual. If you own a home in new york, you'll need to pay property taxes. Learn how property tax exemptions, tax rates, and credits work in new york state. Calculating your annual property tax. Most taxpayers in new york state receive two tax bills each. Is There Property Tax In New York.

From audreymdanielsxo.blob.core.windows.net

Property Tax New York State By County Is There Property Tax In New York There are multiple ways to compare property tax rates across states, as seen in the following table. Your property tax rate is based on your tax class. Calculating your annual property tax. Explore property records (acris) apply for tax. Learn how property tax exemptions, tax rates, and credits work in new york state. The tax rates are listed below. What. Is There Property Tax In New York.

From www.youtube.com

Prepaying Your Property Tax in New York YouTube Is There Property Tax In New York School tax bills are generally the first to arrive. The average effective property tax rate in. Multiply the taxable value of your property by the current. What would you like to do? There are multiple ways to compare property tax rates across states, as seen in the following table. There are four tax classes. The tax rates are listed below.. Is There Property Tax In New York.

From paheld.com

New York City Property Taxes (2023) Is There Property Tax In New York There are four tax classes. Learn how we calculate your annual. Property taxes in new york vary greatly between new york city and the rest of the state. Calculating your annual property tax. There are multiple ways to compare property tax rates across states, as seen in the following table. What would you like to do? The average effective property. Is There Property Tax In New York.

From leavethekey.com

New York Property Tax Everything You Need to Know Is There Property Tax In New York If you own a home in new york, you'll need to pay property taxes. What would you like to do? Learn how we calculate your annual. Calculating your annual property tax. Your property tax rate is based on your tax class. The tax rates are listed below. Learn how property tax exemptions, tax rates, and credits work in new york. Is There Property Tax In New York.

From www.hauseit.com

NYC & NYS Seller Transfer Tax of 1.4 to 2.075 Hauseit® Is There Property Tax In New York Most taxpayers in new york state receive two tax bills each year: What would you like to do? School tax bills are generally the first to arrive. To estimate your annual property tax: The tax rates are listed below. If you own a home in new york, you'll need to pay property taxes. Learn how property tax exemptions, tax rates,. Is There Property Tax In New York.

From www.stsw.com

How State Taxes Are Paid Matters Stevens and Sweet Financial Is There Property Tax In New York Explore property records (acris) apply for tax. Learn how property tax exemptions, tax rates, and credits work in new york state. What would you like to do? Calculating your annual property tax. School tax bills are generally the first to arrive. There are four tax classes. There are multiple ways to compare property tax rates across states, as seen in. Is There Property Tax In New York.

From www.cashbuyersny.com

Latest Property Taxes in New York State Cash Buyers NY Is There Property Tax In New York There are four tax classes. To estimate your annual property tax: If you own a home in new york, you'll need to pay property taxes. Most taxpayers in new york state receive two tax bills each year: Learn how we calculate your annual. The average effective property tax rate in. The tax rates are listed below. Multiply the taxable value. Is There Property Tax In New York.

From www.nyrealestatetrend.com

How To Reduce Property Tax In New York Is There Property Tax In New York If you own a home in new york, you'll need to pay property taxes. Multiply the taxable value of your property by the current. To estimate your annual property tax: The average effective property tax rate in. Explore property records (acris) apply for tax. Most taxpayers in new york state receive two tax bills each year: There are multiple ways. Is There Property Tax In New York.

From www.osc.state.ny.us

Taxes 2020 Financial Condition Report Office of the New York State Is There Property Tax In New York Learn how property tax exemptions, tax rates, and credits work in new york state. Learn how we calculate your annual. To estimate your annual property tax: Multiply the taxable value of your property by the current. The average effective property tax rate in. Explore property records (acris) apply for tax. The tax rates are listed below. There are four tax. Is There Property Tax In New York.

From www.newgeography.com

Metropolitan New York and San Jose Highest Property Tax Burdens Is There Property Tax In New York There are four tax classes. Calculating your annual property tax. There are multiple ways to compare property tax rates across states, as seen in the following table. The tax rates are listed below. Property taxes in new york vary greatly between new york city and the rest of the state. Your property tax rate is based on your tax class.. Is There Property Tax In New York.

From www.hauseit.com

NYC Property Tax Bills How to Download and Read Your Bill Is There Property Tax In New York If you own a home in new york, you'll need to pay property taxes. To estimate your annual property tax: There are four tax classes. Multiply the taxable value of your property by the current. Property taxes in new york vary greatly between new york city and the rest of the state. Learn how we calculate your annual. Explore property. Is There Property Tax In New York.

From www.democratandchronicle.com

Property taxes in New York 5 new findings you should know Is There Property Tax In New York Calculating your annual property tax. School tax bills are generally the first to arrive. What would you like to do? The average effective property tax rate in. Most taxpayers in new york state receive two tax bills each year: Learn how property tax exemptions, tax rates, and credits work in new york state. Your property tax rate is based on. Is There Property Tax In New York.

From www.federalstandardabstract.com

Learn About New York Property Tax in 10 Minutes Federal Standard Abstract Is There Property Tax In New York Your property tax rate is based on your tax class. Calculating your annual property tax. In new york city, property tax rates are actually quite low. Multiply the taxable value of your property by the current. School tax bills are generally the first to arrive. There are multiple ways to compare property tax rates across states, as seen in the. Is There Property Tax In New York.

From www.empirecenter.org

How to compare property taxes in New York Empire Center for Public Policy Is There Property Tax In New York To estimate your annual property tax: The average effective property tax rate in. School tax bills are generally the first to arrive. Learn how property tax exemptions, tax rates, and credits work in new york state. There are four tax classes. There are multiple ways to compare property tax rates across states, as seen in the following table. Most taxpayers. Is There Property Tax In New York.